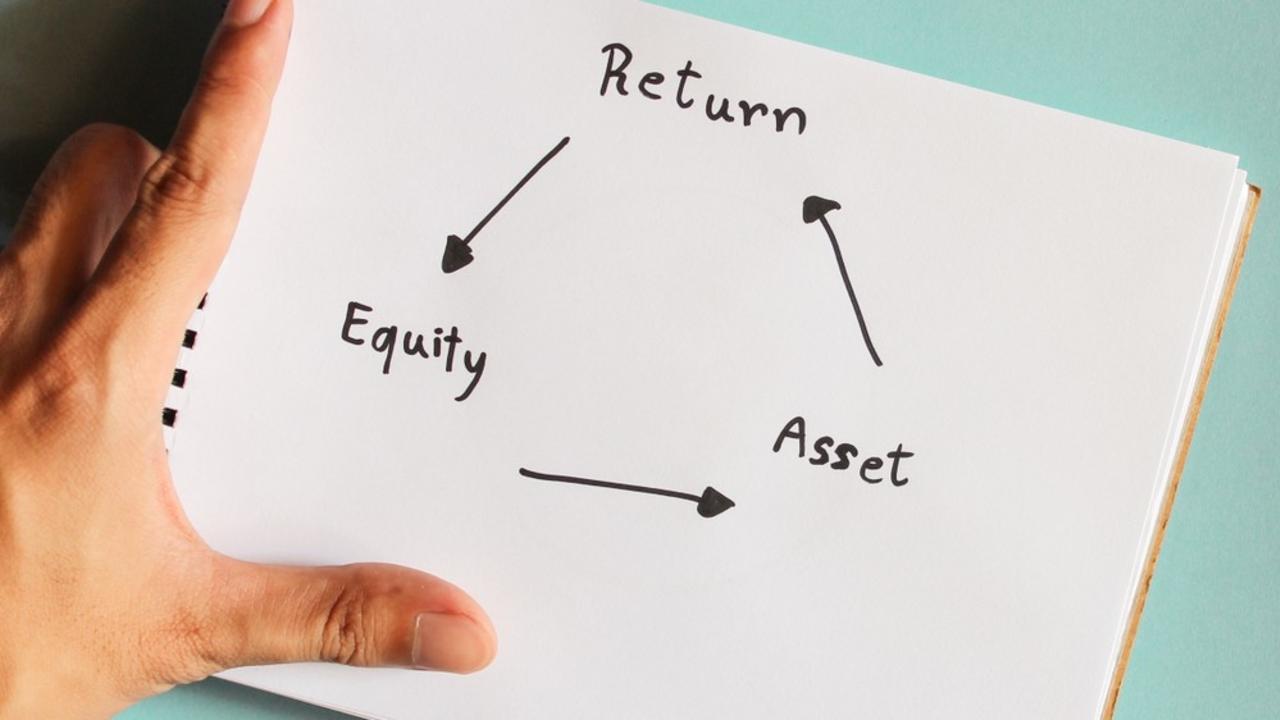

Buy-Refurb-Refinance Summits

In-Person & Livestream Events

Book in now and spend one day with Kevin at an in-person training workshop, or virtually via livestream, to learn how to level up your property career with Buy Refurb Refinance.