Why Property Beats Stocks, Crypto and Shares as an Investment in 2026

Investment comes in many guises - stocks & shares, bonds, crypto, commodities, precious metals - and property. But property is not the same kind of investment as anything else.

Let me ask you a question. If you wanted to invest £400K in crypto, could you go to your bank and ask them to lend you £300K, while only investing £100K of your own money?

My guess is that the idea of a bank manager eager to lend on any investment is making you smile (even if a bit wryly). It just doesn't happen - except with property.

As an investment, property is in a class of its own, because it gives you leveragability.

It's like the difference between an investment and an investor. Is it reactive or proactive? Passive or Active?

What is an investor?

In simple terms it's someone who makes an investment, whether crypto, stocks and shares, commodities, gold, silver. With all of these the investor must pay the going rate. Then trust your judgement that you've made a good investment, while you sit and wait for it to go up.

How do you make that decision on which companies to invest in? Warren Buffett, probably the world's most credible investor, advises:

Never invest in a company you don't understand.

Who has the time to research all the options available? That's why financial advisors have to pass rakes of exams to enable them to give financial advice. They need to have an in-depth understanding of the markets and be able to read performance - and even then, sometimes they get it wrong.

But property is different.

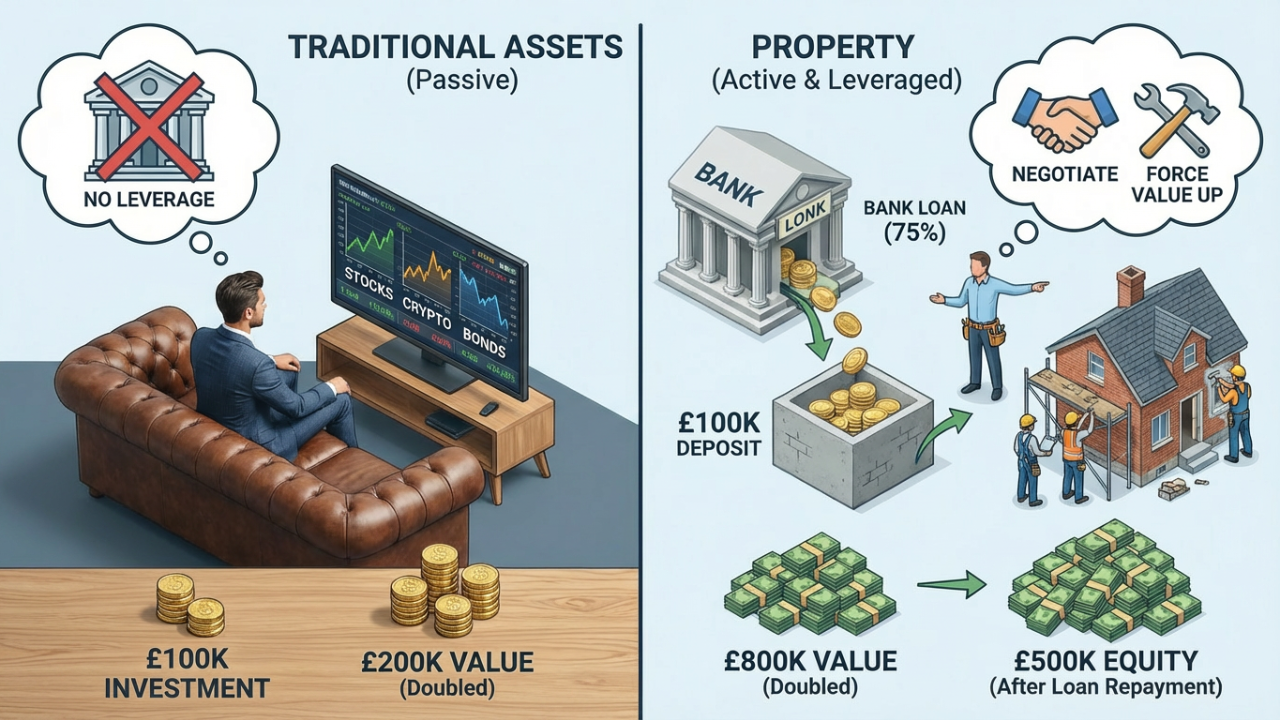

Most investments are passive, there's no leverage. If you buy $100K of Coca Cola shares - that's what you pay. No one is going to sell you $100K of shares for $80K, the share price on the day is the price you pay. Nor will any bank lend you part of that investment money. It just doesn't happen!

This is the definition of passively investing. You can be active in how you choose to invest but having made the investment, you are just along for the ride. Nothing you can do personally influences the value of your investment.

Property is different

Property is unique.

The bank (or another lender) will lend 75% of the current market value of a property. And that doesn't just mean that you get three-quarters of the funding for your investment, but your investment is likely to grow. While, occasionally, property prices drop, they always recover and end up higher than where they started.

So let's look at two scenarios where your investment doubles over a period of time.

1: You invest £100K in shares.

The price doubles over time, so your £100K is now worth £200K. Happy days! You can decide to keep the shares and hope they continue to grow - or cash out at the new price and put your £200K to work elsewhere.

2: You invest £100K in property.

The bank/lender provides a further £300K, so you can purchase a property worth £400K (or maybe two properties worth £200K each). Your £100k becomes the standard 25% deposit with the remaining 75% financed.

Over a given time period property prices double, and now your £400K property is worth £800K.

You can sell the property and invest in more properties, keep it and refinance at the new value, or just leave the equity sitting in the property and accumulating.

The difference is that, when you cash out you have £800K - even after repaying your loan of £300K, that leaves you with £500K, dramatically more than with any other kind of investment.

This is the power of leverage, it has made the same cash investment grow by 5 times. Leverage makes property ratio of growth to investment is much higher than any other investment.

And don't forget that you should also be getting rental income, which will go towards paying back the loan, plus a bit. Consider that as the equivalent of dividend payments on shares.

There are two other elements that are unique to property investment, and this is where it really compounds compared to other investment classes. These elements are where you become an active, rather than a passive, investor.

Negotiate?

When you buy shares, you buy at today's rate on the stock market. The same applies to commodities, precious metals, etc. You have no control over the market value - it is what it is, take it or leave it.

You can't get shares at a discount or a lower value, you buy at whatever the going rate is - regardless. If you asked a stockbroker to 'negotiate a good deal', they'd laugh at you.

Property is different - you can negotiate quite a lot. With a motivated seller you may be able to bring the asking price down as much as 50% below market value in some cases but the ability to be able to buy cheaper is evident.

Force the price up

Now you have your shares, whether their value rises or falls is in the lap of the gods - you have absolutely no influence whatsoever.

You can't force share prices to rise, but property is different. You can increase the value of a property and it's very much within your control.

Buy Refurb Refinance (BRR) is the means of forcibly increasing the value in just a few months.

You can actively increase the value of your investment, by making tangible improvements it.

If you've invested in property and have actively raised its value, you can choose to cash out and sell or refinance and get your money out. Forced appreciation can give you an asset over 12 months with none of your own cash left in.

Property is unique

Property is a unique investment in three ways:

- You can leverage it by only investing 25% of the value and borrowing the rest.

- You can negotiate on the buying price to bake in extra value.

- You can actively increase the value of your investment by forced appreciation.

Property need not be your only asset class but avoiding it could seriously damage your wealth!